Credit card processing fees are a cost of doing business, but many Canadian merchants fall prey to common myths that end up costing them more than necessary. Let’s bust some of those myths.

Myth 1: “All Processors Charge the Same Fees.”

Reality: Processing fees vary widely based on your provider, business type, and transaction volume. Shopping around can save you significant money.

Myth 2: “Lower Rates Mean Better Deals.”

Reality: A low advertised rate often hides additional fees. Always read the fine print and consider the total cost, not just the headline rate.

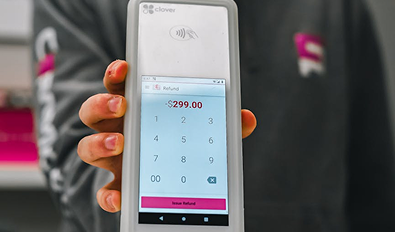

Myth 3: “You Can’t Avoid Processing Fees.”

Reality: Programs like surcharging and cash discounting legally shift fees to customers, reducing or even eliminating your costs.

Myth 4: “Switching Processors Is Too Complicated.”

Reality: Many providers offer seamless transitions, including assistance with equipment and training.

Myth 5: “Customers Hate Surcharges and Cash Discounts.”

Reality: When communicated clearly, most customers accept these programs, especially when they understand the reason behind them.

Final Thoughts

Understanding the truth about merchant processing fees can save your business money and help you make more informed decisions. Don’t let myths hold you back from optimizing your payment strategies.