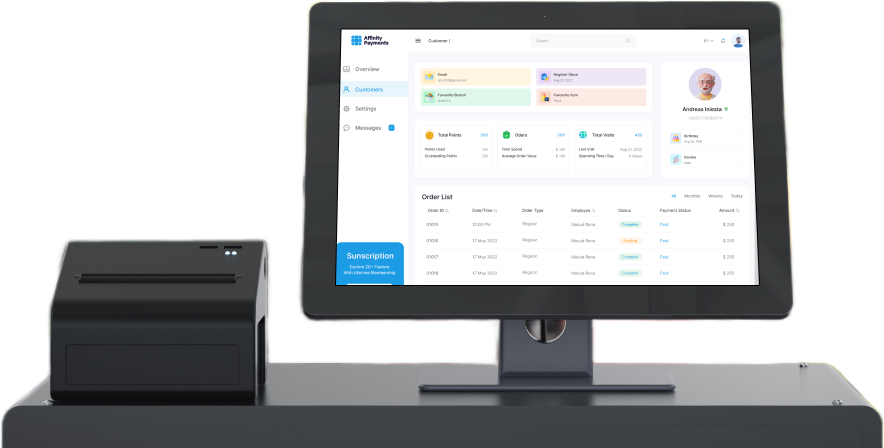

- Discover why over 4,500 businesses love us

More Profits, Less Hassle with Our Payment Solutions

Reduce your credit card fees by 99.7% with Canada’s No. 1 surcharge platform.

Total Saved

$27,000

- in August on fees

Total Saved

$200m

- 230% AVG. Growth

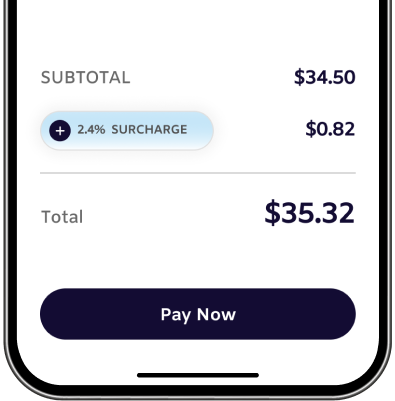

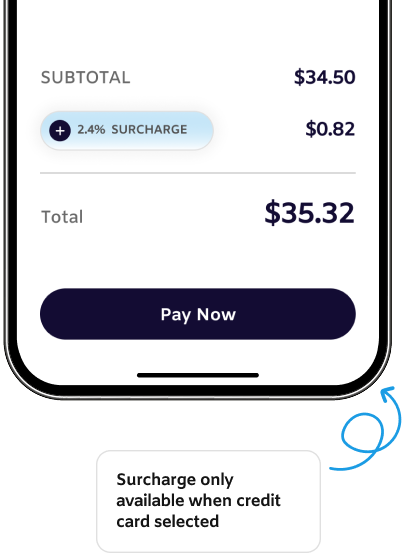

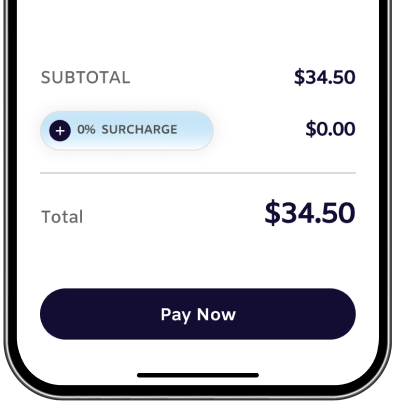

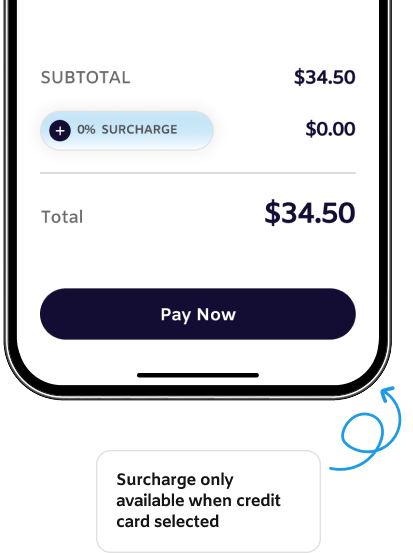

Normally, You Pay Fees of Up to 3% With Affinity, You Keep More of Your Money.

Instead of your business paying the credit card fees, the customer pays a small 2.4% fee. This innovative solution helps you reduce costs and keep more of your revenue.

Surcharge only available when credit card selected

Integration and benefits

Affinity's Pass The Fee Technology seamlessly integrates with your existing payment system, automatically adding a small percentage to credit card transactions to offset processing costs. This allows you to incentivize customers to choose more cost-effective payment methods like debit, EFT, or e-transfer—keeping more purchases fee-free.

With our technology, you can:

- Significantly reduce processing costs without compromising customer satisfaction.

- Seamlessly integrate into your current setup with no downtime.

- Save up to 99.7% of your credit card processing fees.

Product price

$45.00

Customer pays

$45.85

Your business recceives

$45.00

Product price

$45.00

Customer pays

$45.00

Your business recceives

$43.86

Why Businesses Trust Affinity Payments

Unbeatable Rates

Save thousands monthly on processing fees.

Next-Day Payouts

Get funds in you account within 1-2 days.

Global Payment Capabilities

Accept payments from anywhere with multi-currency suppor

Simple Approval Process

Fast, fully online application process.

Your Trusted Partner in Payment Solutions

40+ Partnering Banks

8+ Hardware Brands Supported

10+ Years of Experience

4,500+ Merchants Served

$6B+ Processed Annually

650M+ Transactions Processed per Year

Seamless 4-Step Process

We can complete everything from start to finish within 48 to 72 hours!

Discovery Call & Statement Review

Understand your needs and review your current setup.

Proposal & Savings

Custom proposal highlighting savings.

Underwriting

Fast compliance checks for a smooth transition.

Integration & Go Live

Integration with your system to start processing.

Tailored Solutions for Your Industry

Restaurants

Retail

Travel

Hospitality

Cannabis

Education

Non-profits

Gyms

Insurance

E-commerce

and more

Real stories. Real results.

See how our clients have saved money on credit card fees by switching from traditional payments to Affinity’s Pass The Fee technology.

"We saved $70,000 annually thanks to Affinity Payments!"

CredCredit card fees were eating into our profits every month. Switching to Affinity Payments and using their Dual Pricing Solution saved us $70,000 a year! The extra money has let us enhance our menu and improve the customer experience. The setup was quick, and their team was amazing. Highly recommend!

— Sarah P. Owner of a restaurant chain

"Affinity Payments saved us $1.2 million annually!"

Our company handles millions in transactions, and processing fees were a huge drain. Affinity’s Pass The Fee Technology lets us pass fees to customers, saving $1.2 million last year. Those savings are now funding infrastructure upgrades and better services. I wish we switched sooner!

— Mark T. CFO of an Energy Solutions company

“Affinity saved us $200,000 in one year!”

Running multiple gym locations meant high transaction fees. Affinity Payments helped us cut fees and save $200,000 last year! Their next-day payouts have been great for managing cash flow, and the process was fast and easy. Highly recommended!

— Jessica R. CEO of 6 Gym locations

Find Out How Much You Could Save

Monthly credit card transaction volume

$

00.00

Your Questions, Answered

What types of businesses can benefit from your services?

Any business that processes payments, from restaurants and gyms to e-commerce and high-risk industries, can benefit from our cost-saving solutions.

How quickly can I access my funds?

With our next-day payout options, you can receive funds in your account within 1-2 business days.

Do you guarantee lower processing rates?

Yes, in 99.99% of cases, we beat your current rates and help you save significantly.

Can I use my existing POS system?

Absolutely! We can integrate with most POS systems or provide free terminal replacements if needed.

Is your Dual Pricing Solution compliant with card brands?

Yes, it’s fully compliant with Visa, Mastercard, and other major card networks.

How long does it take to get started?

We can get your business set up and processing payments in 48-72 hours.

Do you offer support for high-risk industries?

Yes, we specialize in high-risk businesses like CBD, firearms, and travel, ensuring reliable payment solutions.